Looking for inspiration

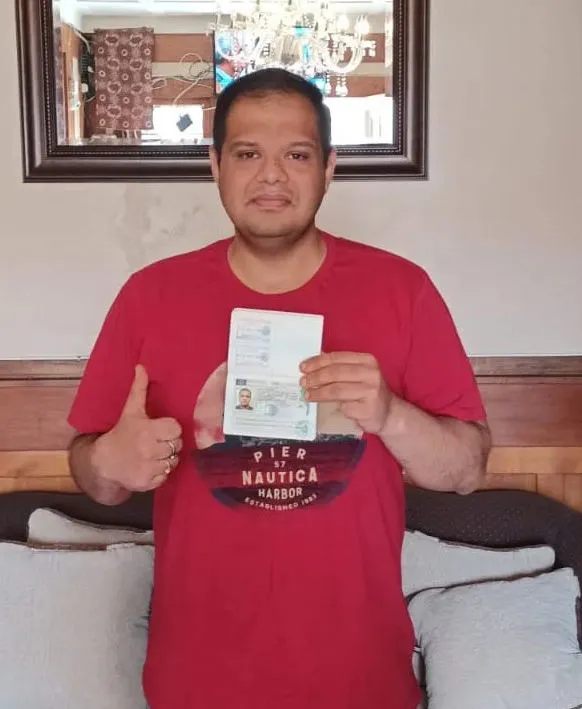

Global clients share how AtoZ Serwis Plus helped them secure work permits, visas, and career support across Europe. Real stories. Real results.

At AtoZ Serwis Plus, we help you become a global citizen with trusted support for jobs abroad, overseas education, and visa processing tailored to your goals.

Read MoreOur Solutions

Connecting employers, job seekers, students, and agencies across Europe and beyond.

Register as an Employer Partner!

Looking to hire skilled or semi-skilled workers from Asia, Africa, the CIS, or EU countries? AtoZ Serwis Plus supports your recruitment needs for Poland, Germany, Slovakia, Hungary, Lithuania, Estonia, and beyond. We deliver comprehensive legal recruitment services, visa support, and seamless onboarding solutions tailored to your business goals. Partner with us to build a reliable, compliant, and efficient workforce.

EmployerJob Seekers Registration!

Looking to hire skilled or semi-skilled workers from Asia, Africa, the CIS, or EU countries? AtoZ Serwis Plus supports your recruitment needs for Poland, Germany, Slovakia, Hungary, Lithuania, Estonia, and beyond. We deliver comprehensive legal recruitment services, visa support, and seamless onboarding solutions tailored to your business goals. Partner with us to build a reliable, compliant, and efficient workforce.

Job SeekersRegister as a Recruitment Partner!

Are you a recruiter looking to place workers in Poland, Germany, Slovakia, or other EU destinations? AtoZ Serwis Plus provides you with trusted employer connections, legal recruitment solutions, verified job placements, and full visa assistance. Expand your recruitment business with confidence, supported by clear processes, reliable documentation, and transparent migration services.

RecruiterDo you have any questions?

Looking to work and live in Europe? At AtoZ Serwis Plus, we’re here to guide you every step of the way. Our experts provide support with job search assistance, work visa applications, qualification recognition, and European language learning. To connect with us and get started on your European journey, click one of the contact icons below.